When Shai Gilgeous-Alexander agreed to a four-year supermax extension last week, he didn’t merely celebrate the end of his magical season with a massive new paycheck. The NBA MVP and Finals MVP also came close to an unprecedented financial threshold.

In 2030-31, the fourth year of Gilgeous-Alexander’s new deal, he is projected to earn $79 million. That amounts to more than $963,000 per game — putting him close to the NBA’s first contract worth a million dollars per contest.

Even if Gilgeous-Alexander won’t reach that milestone, the NBA’s richest players grow even richer. When former MLB pitcher Nolan Ryan became the first professional athlete to sign a contract that would pay him a million dollars per year in 1979, it was the day’s top sports story in The New York Times.

So let’s examine the factors behind the NBA’s next financial breakthrough, the top candidates to achieve it and its ripple effects for star salaries and the league writ large.

Reasons behind skyrocketing superstar salaries

The top of the NBA’s salary scale has raced upward because of two key factors: the existence of the supermax extension — officially the “designated veteran extension” — and a rising salary cap.

In 2017, the new collective bargaining agreement created the supermax tier of contracts. Now, players who have been in the league for seven to eight years, have been with the same team for the duration of their contract and have met certain awards criteria are eligible to sign extensions that start at 35% of the salary cap. Gilgeous-Alexander became the 14th player to sign such a deal.

The supermax is extra lucrative because of “basketball inflation,” which has increased at a much greater rate than general inflation. A decade ago, the salary cap sat at $63 million, which is about $85 million in today’s dollars, given national inflation trends. But the 2024-25 salary cap was $141 million — a two-thirds increase compared to that expectation.

These trends have combined to raise the sport’s largest salaries quicker and higher than ever. And they’ll continue to skyrocket as the league’s new TV deal comes into effect next season, bringing with it a surge of new money.

Last summer, the NBA and its television partners signed an 11-year contract worth $76 billion, or nearly $7 billion per season. For comparison, the old TV deal, which expired at the end of the 2024-25 Finals, was worth $24 billion over nine years, or almost $2.7 billion per season.

In other words, the new national rights deal will give the NBA about 2.6 times as much money per season as the one it replaced.

That influx of cash will have a profound impact on the salary cap, and by extension, the supermax. The last time the NBA added new multiples of national TV money, the salary cap leapt by 34% in one summer, giving the Golden State Warriors enough space to sign Kevin Durant. To prevent a repeat, the new CBA includes “cap smoothing” measures, with maximum cap increases of 10% each season.

The salary cap will indeed increase by 10% next season, raising the starting supermax salary by 10%. In 2026-27, however, the NBA projects a 7% increase, as the collapse of regional sports networks reduces the amount of local TV revenue for the league.

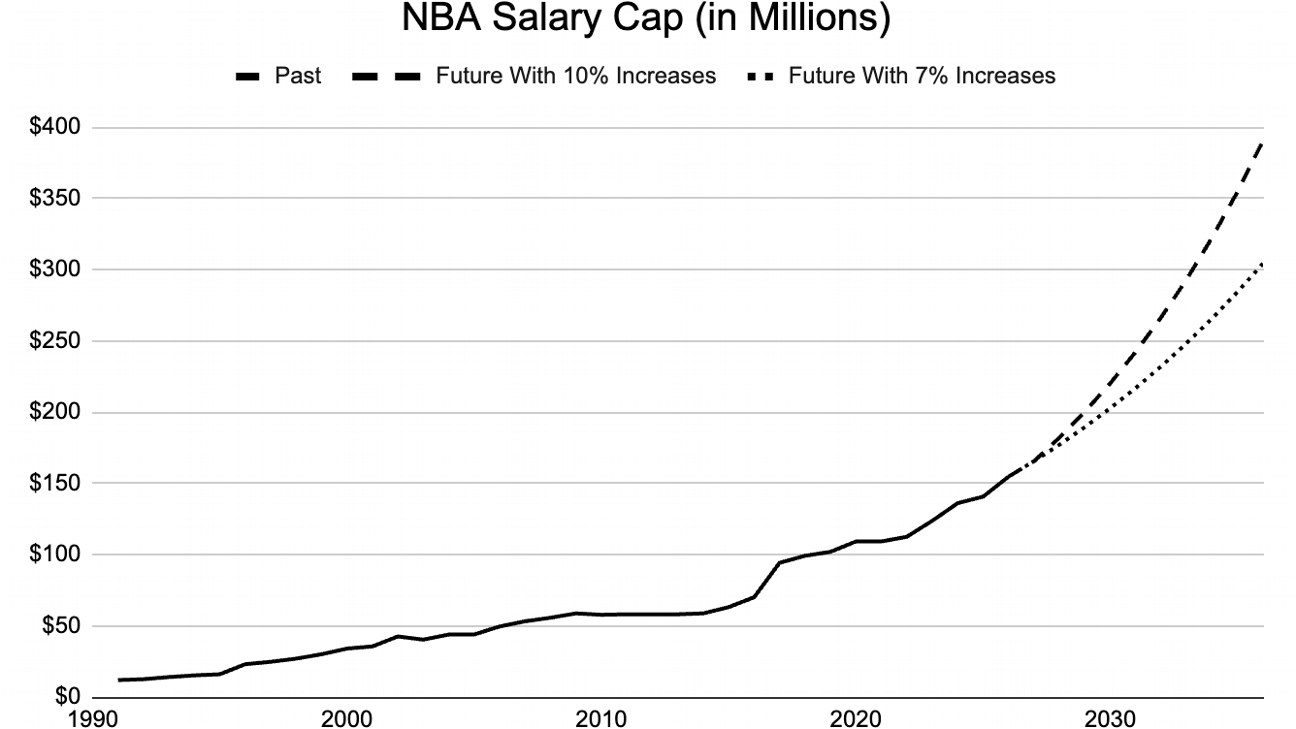

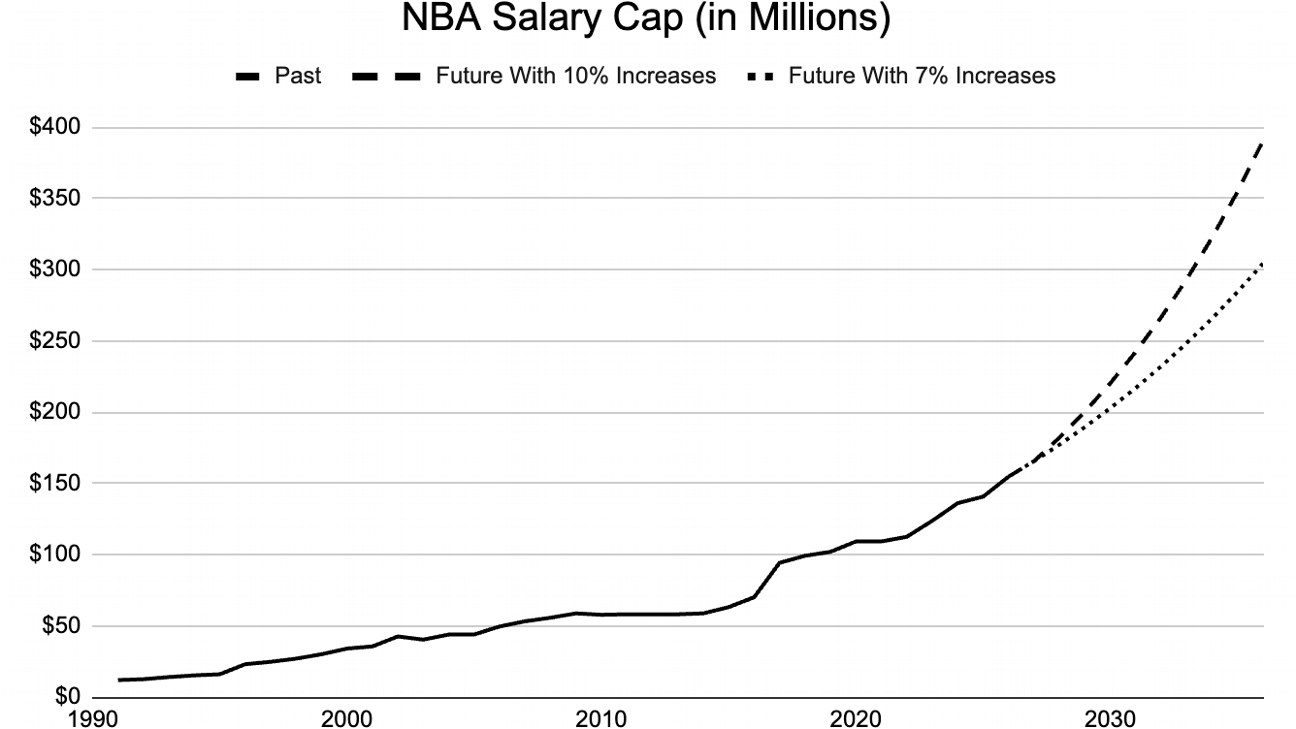

Even if it’s not as dramatic as a one-time 34% increase, repeated 7% or 10% jumps will have a similar leaguewide effect after a few years. Consider this illustration: The salary cap will pass $150 million for the first time next season, but it could double and pass $300 million by 2033-34. Such is the power of compound interest.

The resulting effect on supermax salaries is staggering. When Stephen Curry became the first player to sign a supermax for the 2017-18 season, the cap was $99 million, so 35% meant his contract started at $34.7 million.

It took five years for the supermax value to rise above $40 million. But then the pace sped up as the salary cap climbed: three more years to eclipse $50 million, a projected two more years to reach $60 million and only one additional projected year to pass $70 million.

Larger first-year salaries also mean larger raises over the course of a supermax deal. This chart shows the projected starting and ending salaries for upcoming classes of four-year supermaxes, assuming — for the sake of this maximal projection — annual 10% cap increases after 2026-27. SGA’s contract, for instance, will start at $63.7 million when it begins in 2027-28 and rise to $79 million by Year 4. Other players who sign a supermax after him will eclipse the $82 million mark, or $1 million per game, by the end of their deals.

This chart is predicated on a few assumptions: First, the supermax structure will remain the same after the CBA expires at the end of the decade; and second, that the league will return to 10% salary cap increases after 2026-27. That might not be likely, so here’s that same chart with 7% annual increases instead.

Top candidates to reach $1 million per game

Based on those charts, the best bets to reach $1 million per game first are players who will sign supermax deals after Gilgeous-Alexander, who was drafted in 2018.

Among the 2019 draft class, Ja Morant is the only player to make an All-NBA team, and that was three years ago. It seems unlikely anyone in this draft class will qualify for the supermax.

However, the 2020 draft class offers two top candidates for supermax qualification: Anthony Edwards and Tyrese Haliburton. It’s unknown for Haliburton since he’ll miss all of next season due to an untimely Achilles tear. But Edwards has made two All-NBA second teams in a row, putting him on track to sign a supermax in the summer of 2027, which could be worth up to four years and $345 million and rise above $82 million in the second season.

If not Edwards, two members of the 2021 draft class made their first All-NBA teams last season: Cade Cunningham and Evan Mobley. Other promising members of that draft class include Scottie Barnes, Alperen Sengun and Franz Wagner.

But granting even modest annual cap increases between now and the 2030s, it’s highly likely that whomever of Cunningham, Mobley and their contemporaries qualifies for the supermax will make more than $1 million per game at some point.

And as the cap keeps climbing, more and more young players will be able to earn unprecedented sums on the basketball court. Recent draftees, like the class of 2022’s Jalen Williams, Chet Holmgren and Paolo Banchero, and the class of 2023’s Victor Wembanyama and Amen Thompson, could realistically sign contracts worth more than $100 million per year.

Experienced veterans signing shorter extensions could also cash in for nine figures annually — including Gilgeous-Alexander, when he signs his next lucrative extension after his supermax is up in 2031. Just this week, the Phoenix Suns‘ Devin Booker agreed to a new two-year extension worth up to $145 million, which carries a higher annual value than SGA’s recently signed supermax (though because his deal is shorter, it won’t reach as high by the end as SGA’s).

NBA following other leagues

Although a player making a million dollars per game is unprecedented in basketball, other sports have already surpassed that number.

At the start of the 2020s, Major League Baseball pitchers such as Gerrit Cole and Justin Verlander began to cross $35 million per season, or more than $1 million per game in roughly 32 starts. This is a useful model for the NBA. Public advanced stat models estimate that the best basketball players are worth about 20 wins per season, which comes out to about one win in every four games. Similarly, the best baseball pitchers are worth about eight wins above replacement per year, or the same one in four math.

This isn’t a perfect comparison, but the best NBA players have about as much impact on winning a single game as an MLB ace on the mound, so it’s logical that their salaries would follow suit.

Other leagues pay their players even more. In the NFL, 84 players have cap hits of $17 million or higher this season, according to Spotrac, meaning they’ll earn at least $1 million per game. The league’s top quarterbacks make nearly $3 million per game — which makes sense on a relative basis, given how much quarterbacks affect the result of games and given that each NFL game matters more in a shorter schedule in the richest sports league in the country.

Wealthiest of all are the elite soccer players the Saudi Pro League has recruited with exorbitant sums of money. Cristiano Ronaldo is rumored to earn around $200 million a year.

But among team sports not funded by sovereign wealth funds, the NBA stands out with its combination of per-game pay and volume. MLB pitchers and NFL stars play only a fraction of the games as their NBA counterparts, so even if they make more on a per-game basis, their total compensation is still far below that of the NBA’s supermax elite.

Consider this data point: Next season, 15 NBA players have cap hits of $50 million or higher, per Spotrac. The NFL, NHL and MLB have just two such contracts combined: New York Mets outfielder Juan Soto and Dallas Cowboys quarterback Dak Prescott.

Ripple effects of a soaring salary cap

As star salaries soar, several possible ripple effects could emerge in the NBA. Load management could become even more of a lightning rod, for instance, with less tolerance for such highly compensated players missing games. It’s easy to predict the criticism: You’re making more than a million dollars tonight, and you’re not even playing?!

Higher salaries could also impact transactions. Some NBA stars could weigh factors other than money when making career decisions. It’s natural for competitive athletes to desire the max, as a status symbol and a boon to their bank accounts. But as the numbers keep climbing, is there any tangible quality of life difference for making $75 million per year versus $85 million?

If not, stars could be more inclined to test the free agent market instead of re-signing with the team that can offer the supermax, knowing they’ll gain multigenerational wealth regardless. Others could opt to sign for less than the maximum possible amount, to save money for teammates who would otherwise be unable to fit under the punitive second apron.

Finally, even if player salaries remain a constant percentage of the salary cap, the sheer numbers could grow so large that they provoke new conversations about whether NBA stars are overpaid. But here’s the twist: SGA is already worth nine figures per season, even before his contract catches up.

Will superstars be worth $1 million per game?

1:14

Are LeBron James and Steph Curry done winning titles?

Tim Bontemps breaks down the Lakers’ and Warriors’ title hopes with LeBron James and Stephen Curry and why the Lakers’ future hinges on Luka Doncic’s commitment.

Last season, between salaries and luxury tax payments, NBA teams shelled out $5.65 billion, according to Spotrac data. There are 1,230 wins available in the regular season, so that comes out to $4.6 million per win. (There’s a nerdy debate to be had about whether to factor in wrinkles like minimum salaries and replacement levels to determine the “true” cost of a win. But this simple calculation suffices for now, and if anything, including those other factors would make stars seem more valuable, not less.)

Multiply that sum by Gilgeous-Alexander’s league-leading total of 20.9 estimated wins of value, per Dunks & Threes, and you get $96 million in regular-season value. And that’s before accounting for how SGA led his team to the championship, or increased his franchise’s ticket and merchandise sales, or boosted Oklahoma City’s franchise value.

For reference, when LeBron James returned to the Cleveland Cavaliers in 2014, Forbes estimated that he “immediately elevate[d] the Cavaliers franchise value by at least $100 million to $150 million.” That figure would surely be higher now after another decade of inflation.

Given the presence of contract maximums and the relative importance of stars in the NBA, the league’s best players have long signed for discounts, relative to their production, and that will still be true at $1 million per game or more. In 2016, ESPN’s Kevin Pelton calculated that, taking all these factors together, “in a world without limits on player salaries, the Cavaliers could easily justify offering James $100 million a year.”

As Pelton noted, that was more than the entire salary cap at the time, similar to how Michael Jordan made more than the entire salary cap for the Chicago Bulls in the late 1990s, before the NBA introduced the max contract structure. The same math in 2025 would place top stars’ value north of $150 million per year — or nearly double the $1 million per game threshold.

That’s not true for every player on a max contract — in a zero-sum environment, there will always be players who exceed their value and others who fall short — but for the LeBrons and Jordans and SGAs of the world, for the truly franchise-altering, league-defining players, this takeaway is clear.

A supermax salary that reaches $1 million per game won’t just be a milestone when it’s finally reached in the next several years. It will also be a bargain.

Source link